Venture Capital Insights from Harvard Business Review

[This is a copy of a LinkedIn post, slightly edited]

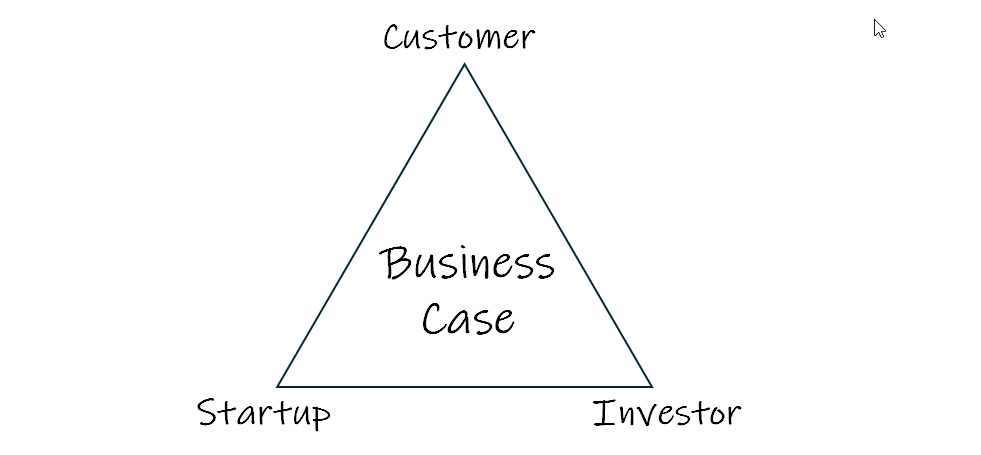

Venture Capital has played an undeniably pivotal role in the growth of many of today's most successful companies. VCs not only provide funding but often bring a wealth of experience, networks, and strategic insights. Like any industry, it's a mixed bag, with its share of highs and lows. I just stumbled upon an article from HBR that discusses some common misconceptions about VCs. Not all VCs fit into these generalizations and many offer tremendous value beyond capital. Nevertheless: it's an interesting read that provides a different perspective.

Literature:

- Original article: https://hbr.org/2013/05/six-myths-about-venture-capitalists

- Also referred to: https://www.angellist.com/blog/what-angellist-data-says-about-power-law-returns-in-venture-capital

❓"Myth 1: Venture Capital Is the Primary Source of Start-Up Funding"

💡 "Historically, only a tiny percentage (fewer than 1%) of U.S. companies have raised capital from VCs. "

❓"Myth 2: VCs Take a Big Risk When They Invest in Your Start-Up"

💡VCs have a 2/20 compensation model: They get 2% of the paid-in capital per year as a management fee and 20% of the potential returns; according to the article, 99% of the money the VCs invest is not money of the General Partners (the people who set up and manage the fund).

❓"Myth 3: Most VCs Offer Great Advice and Mentoring"

💡 Some do, some don't, according to the article. Do your due diligence.

❓"Myth 4: VCs Generate Spectacular Returns"

💡 "We found that the overall performance of the industry is poor." [...] "The average fund, however, breaks even or loses money."

Can't comment on this since I don't have data. But AngelList has published some material on this (and the next one); see article mentioned above.

❓"Myth 5: In VC, Bigger Is Better"

💡 The power law suggests that bigger funds have a higher probability of hitting one or more unicorns which increases the fund performance significantly. However, there seems to be a limit: "But industry and academic studies show that fund performance declines as fund size increases above $250 million." Not entirely implausible: A fund needs a certain size to hit the unicorns (I'd guess 100M+) but once they reach this point, scale effects probably only work to some degree.

❓"Myth 6: VCs Are Innovators"

💡The article claims that most innovation in the industry came from outside. "It’s ironic that VC firms position themselves as supporters, financers, and even instigators of innovation, yet the industry itself has been devoid of innovation for the past 20 years."